by: Grant Marais

A review of the literature has identified numerous variables with can impact on a customer’s loyalty, but in trying to identify what impact on loyalty the actual customer experience using a digital imprinting point of view, little seemed to have been written to date. This study is primarily inductive, beginning with exploring literature on consumer based brand equity and customer loyalty, the customer experience and to identify the nature of any relationship between the two concepts. Studies presented around consumer based brand equity indicate the overall experience around brands is key to achieving resonance or loyalty. This study aims to explore the importance of these variables and the impact it has on consumer based brand equity and ultimately customer loyalty.

Figure 1: Disposable Income for U.S. Shoppers (Wallace, 2015, p. 10)

Figure 1: Disposable Income for U.S. Shoppers (Wallace, 2015, p. 10)

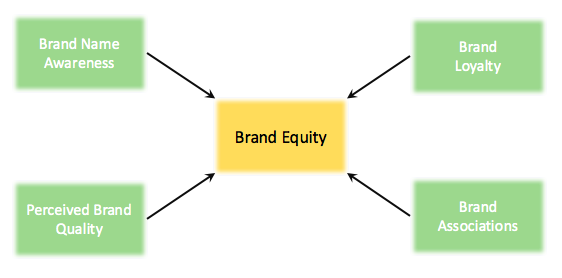

Figure 2: The Major Elements of Brand Equity (Dibb, et al., 2006, p. 11)

Figure 2: The Major Elements of Brand Equity (Dibb, et al., 2006, p. 11)

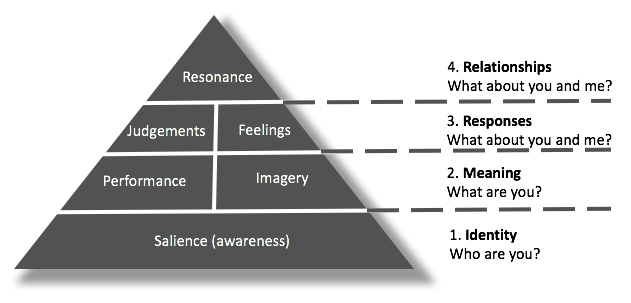

Figure 3: Keller’s pyramid model (Keller, 2003)

Figure 3: Keller’s pyramid model (Keller, 2003)

Retailing has fundamentally transformed during the past twenty years. And while e-commerce had initially transformed the face of retail, Wi-Fi is behind the next wave of change. Retailer operators are embracing new technologies such as Wi-Fi to redefine everything from merchandising to customer care. This study will analyse Consumer Based Brand Equity, and what impact it ultimately has on customer loyalty, within the context of large shopping malls within South Africa. This context was chosen for its popularity in contemporary South Africa since, the South African retail environment is such that most shopping takes place in large indoor malls in contrast to Europe where high street shopping districts exist.

A review of the literature has identified numerous variables with can impact on a customer’s loyalty, but in trying to identify what impact on loyalty the actual customer experience using a digital imprinting point of view, little seemed to have been written to date. This study is primarily inductive, beginning with exploring literature on consumer based brand equity and customer loyalty, the customer experience and to identify the nature of any relationship between the two concepts. Studies presented around consumer based brand equity indicate the overall experience around brands is key to achieving resonance or loyalty. This study aims to explore the importance of these variables and the impact it has on consumer based brand equity and ultimately customer loyalty.

The field work for this study comprised of online survey, which asked visitors to major malls targeted questions. The data collected was transcribed, and coded to allow for in-depth analysis to explore participant’s perceptions, views on product, service delivery, loyalty and what makes them loyal to an individual establishment or brand.

The research concludes that marketing via public Wi-Fi in malls can impact all levels of Keller’s (2009) brand resonance pyramid but particularly users’ emotions and thoughts through active engagement with the brand and how a sense of community can be built around the brand. The findings provide useful managerial implications for how the big data insights that Wi-Fi networks can yield should be incorporated into the overall marketing mix and consumer segmentation strategies.

CHAPTER 1. INTRODUCTION

Because of urban planning and more recently accelerated by the extreme violent and ever increasing crime rate in South Africa (BusinessTech, 2017), the security and convenience of an indoor mall makes them particularly appealing for shoppers. By gross number, South Africa has the sixth highest number of mall in the world (Smith, 2015). And whilst by retail space per capita it is only a fifth of that of the US which has the highest mall space per capita, South Africa has a significantly higher unemployment levels (Statistics South Africa, 2017) combined with a lower retail spend per capita, this tends to support that South Africa is over shopped with developers warning of tenant failure (Financial Mail, 2015).

Within this competitive environment, it is felt of greater importance to develop customer focused strategies to maintain customer loyalty through building brand equity. In modelling customer based brand equity, Keller reasoned that “Marketing communications can create intense, active loyalty relationships and affect brand equity” (Keller, 2009, p. 151). He and others have expanded on his initial (1993) work to include the experiences built around a brand with a view to achieving Brand Resonance (Aaker, 2004; Keller, 1993; Keller, 2001; Keller, 2009; Kotler, 2000)

Whilst traditional advertising does still work, the aim is to explore if there are other elements that can be used to in addition to traditional media to augment the traditional path to purchase? The focus of this paper is to look further than conventional advertising and determine if or how it can influence consumer behaviour and possibly influence consumer based brand equity to build more loyal customers. Emphasis will be on how consumers react to highly targeted advertising delivered via Wi-Fi with location awareness, as well as other benefits deploying a venue based Wi-Fi system could yield for mall operators. The study will not consider the technicalities of deploying and operating the Wi-Fi network, but rather explore what outcomes could result in having one deployed.

“Brand Equity” describes the economic value attributable to a brand name and the ability to generate more income from products associated with that brand versus products from lesser or unknown brands (Leuthesser, et al., 1995; French & Smith, 2013; Spry, et al., 2011). Importantly, Kim et al (2003) determined that brand equity did not only apply to physical products. An emerging area of research has become destination branding, but remaining is the question as to whether previously accepted branding principles can be applied to destinations (Konecnik & Gartner, 2006). And, whether a customer-based brand equity methodology which has customarily been developed for product brand (and partially for services) can be transferred or applied to destinations.

Generally acknowledged is that there are three major components of brand image are termed cognitive, affective, and conative (Lindemann, 2010; Richards & Curran, 2002; Sritharan, et al., 2008). The cognitive component establishes awareness: what someone differentiates or thinks they know about a brand or destination. The affective component is based on how one feels about this understanding. The conative component is the action step; how one acts on the evidence they have about the brand (destination) and how they feel about it (a destination) (Vinhas Da Silva & Faridah Syed Alwi, 2006). As marketing theory continues to evolve as an emotive topic, consumer based brand equity which is built upon the Lovemarks (Saatchi & Saatchi, n.d.) concept, is becoming increasingly important in delivering experiences to consumers to build long term loyal relationships. In applying qualitative research, it will provide important information about the “human” side of an issue – that is, behaviours, beliefs, opinions, emotions, and relationships of individuals. This should give some insight into how the marketing mix is approached to positively influence consumer behaviour.

1.1 Technology is driving marketing engagement

As populations age, there is a cyclical changeover as the current youth becomes of age and develops into the next generation of consumer. In changing the marketing mix, technology plays an ever-increasing role in the communication medium. Fromm & Garton (2013) provide important insights into future generations of consumer, they explore how Millennials or Gen Y respond to marketing. Fromm & Garton (2013) used Boston Consulting Group research data to understand how these groups identify themselves. The dominant phrases used when describing themselves as a group have technology and innovation associated with them: Tech-Savvy, Digital, Creative, Computer, Open-Minded, Hip, Electronic, Savvy. As early adopters, they are looking for experiences that are fun and interactive. More than any other generation, Millennials rely on each other, sharing opinions with friends to make more informed decisions. They have technology at their fingertips (smartphones) and a number of platforms by which they communicate (Facebook, Instagram, Twitter, etc.). Mall operators need to be cognisant that traditional communication mediums are becoming obsolete in a society dominated by digital communication and social media with its ability to influence anyone. Their influence is so concerning, governments are worried about the ability for the likes of Facebook to influence election outcomes through its targeting (Bershidsky, 2017). If targeted digital advertising can influence voters in one direction or the other, it becomes easy to draw a conclusion that they are able to do the same for brands, services or destinations. Targeting millennials now is vitally important to long term survival since they will have greater purchasing power (because of their education) and far more influence (because of their numbers).

Much has been written about their use of data and devices with the same conclusions: Millennials see technology not just as a device or platform for communication but a way to improve their life, make informed choices, and contribute to society (Shankar, et al., 2010; Sultan, et al., 2009). It is an understatement to say technology is a momentous influence in how this generation communicates. Ongoing engagement is indispensable to keep Millennials engaged with a brand and feeling like it is adding value to their lives (Shankar, et al., 2010). “Brands entering or competing in both emerging as well as established markets may seek to emphasize the mobile platform for advertising and promotional efforts in order to capitalize on favourable acceptance characteristics such as current mobile activity and the growing usage of mobile devices” (Sultan, et al., 2009, p. 318).

1.2 Retail malls, their competitive environment is increasing

“The perfect storm has been created by developers’ and retailers’ overzealous expansion in recent years, amid dwindling consumer spending” (Muller, 2017). With more channel options today, consumers have never had so much choice. However, they expect that their interactions, that build brand experience which boost loyalty and retention, be more seamless. It has become absolutely necessary for retail operators to offer a consistent brand message through a multi-channel strategy, which needs to offer a robust a consistent experience. Every single touch point along the shopper’s experience must be viewed as vital to the customer’s ultimate purchasing decision, and one of the important external factors is the physical environment of the mall the shopper needs to find their retailer in. Whilst competition has been robust in healthier economic times, the overtraded area of malls in recessionary conditions means it is now a fight for survival between mall operators to retain existing customers (to their mall) whilst trying to poach customers from their competitors which now include strong online competitors.

1.3 Has e-commerce killed brick and mortar retail?

What about Online shopping? Has it dealt a death blow to traditional retail activities that happen in a mall? Whilst there appears to be no definitive research for South Africa, in the USA despite the rise of e-commerce, brick and mortar retail stores remain as relevant as ever with 70% of consumers still preferring to buy from a physical store (Wallace, 2015). Retail statistics presented by Wallace (2015) on the USA show that although e-commerce is growing, most consumer spending will still occur in a physical store (see Figure 1). The chart shows two important factors, online will double between 2014 and 2020, but the growth in sales at physical stores in gross dollar level spend still be more than double that of the e-commerce growth. Brick and Mortar stores still need to compete for customers, but it is not an online world yet. This holds even more true in South Africa where e-commerce sales were expected to represent little more than 1% of total consumer spend in South Africa during 2016 (Goldstuck, 2016). As online spending is substantially less in South Africa compared to the USA, it can be concluded that the relative level of money spent in stores will still be many multiples of what is spent online, even when projected out to 2020, meaning the relevance of brick and mortar retailing in South Africa has not diminished.

The main objective of this study is not to identify gaps in existing literature, but rather to enrich them through the subject of customer experience to drive consumer based brand equity, and ultimately loyalty.

CHAPTER 2: LITERATURE REVIEW AND THEORY

2.1 Introduction

The chapter begins with a review of the role of branding and its applicability to the shopping mall. Extensive reading was conducted to determine if a venue such as a shopping mall can have a brand and/or brand identity of its own. And if so, what commonality exists with building a community of loyalists around that brand? It then reviews the elements of building equity around a brand and how recent theory is centred around achieving resonance with a consumer to have a brand that the equity or value towards it is driven by the consumer themselves. Finally, an appraisal is conducted of research findings on consumer responses to interactive digital marketing activities and public Wi-Fi before the theoretical framework for this research is explained.

2.2 The shopping mall as a brand

One of the more important trends in retailing is becoming the rise of the retail brand and destination with customer loyalty as the critical goal within an environment that has low switching costs and increasing competition (Allaway, et al., 2011; Çifci, et al., 2016). As these retail brands and destinations evolve within a crowded marketplace they need to invest in one or more equity drivers that could differentiate them and the experience they offer (Parsons, 2003). And retail managers need to ensure that consumers interpersonal goals are achieved through a brand experience that provide high social value (Çifci, et al., 2016).

Shopping mall developers and operators are always keen to attract, entice and retain the shoppers in the mall by creating exciting shopping experiences that are unique to their venue. Jooste, et al (2012) define brand equity as the positive deferential effect on customer response to a product or service that results from the association with the brand name. Aaker & Joachimsthaler (2000), on the other hand, refer to brand equity as a strategic asset that can be the basis of competitive advantage and long term profitability.

2.3 The shopping mall brand and experience

Since medieval times branding has been a common practise, whether a blacksmith marking their insignia on a sword or a potter that marked their logo on the bottom of crockery. Brands have continued to evolve to distinguish products from their competitors and to help buyers avoid inferior quality knock offs. No longer simple identification marks, brands have developed into powerful and emotive marketing tools. Customer based brand equity involves a set of memory based associations to a brand that remain memories in the minds of consumers (Keller, 2003).

Today, brands have representative value for companies and customers, respectively discussed as financial-based and customer-based brand equity (Kotler, 2000; Lindemann, 2010). The differences that consumers identify in various brands may be tangible or intangible, and either functional or rational, in other words carrying more imagery or sentiment in respect of what the brand stands for.

The shopping mall brand experience can be quantified as the consumers’ response toward the marketing activities offered by a shopping mall which includes sensory, emotional, perception, and behavioural experiences (Wan Kim, et al., 2015). A shopping mall is an important retail setting that contributes to shoppers' overall experience of the retailer that is visited within the mall, as an example the lack of parking or dirty restrooms would leave a negative connotation in the consumers mind about not only the mall, but the retailers within that mall.

‘Mall-Goer’, ‘Mall Rat’, ‘Mall Junkie’ are phrases that have commonly been used to describe persons who frequent malls often, but “shopping malls serve not only as places to shop but also as public spaces hosting the local community” (Gilboa & Vilnai‐Yavetz, 2013, p. 255) And although consumers purchase products whilst at the mall, not all their time there consists of shopping, nor is every visit based around purchasing something, their activity has become a mix of shopping and something that has become a habitual cultural routine (Tandon, et al., 2016; Wan Kim, et al., 2015). “Malls are an important part of a consumer’s lifestyle as they contain shops, restaurants, entertainment and more all under one roof” (Lloyd, et al., 2014, p. 37). Retail has morphed into “Retail-tainment” (Gleser, 2015).

Shoppers are increasingly choosing a mall where their overall well-being and experience is considered, these criteria or assessments looks beyond the tenant mix, but utility elements such as parking, free Wi-Fi services, entertainment value as the mall is becoming where they come to consume not only products and services but to socialise amongst themselves (Hedhli, et al., 2013; Shilpa & Rajnish, 2013). Although in communicating to consumers they share the same advertising, symbol or logos, the brand personality and the store personality are differentiated through instore experience and atmosphere (Baker, et al., 2002; Gilboa & Vilnai‐Yavetz, 2013). But for consumers these two memories become linked. The impact of the mall brand experience and personality on the satisfaction of the mall and its loyalty is a key element of differentiation of the shopping mall (Gilboa & Vilnai‐Yavetz, 2013; Wan Kim, et al., 2015). “Shopping can be valuable from a task-oriented stand- point where a consumer finds an intended item, receives an intended service, or gathers useful information. Shopping also can provide value experientially in the form of immediate personal gratification” (Babin & Attaway, 2000, p. 92).

Using the categories as described by Berman and Evans (1995) regarding the atmospheric stimuli or elements retail shops and malls of, the exterior, the interior, the layout and its aesthetic design, and the point-of-purchase with its decoration variables, we can see the utility of in-store Wi-Fi overlapping many of these elements as the virtual brand extension and communication medium. “Holistically engineered customer experience may allow retail organizations to generate value for customers more effectively than assiduously defined relationships” (Tandon, et al., 2016, p. 637). Advances in technology present several opportunities for digital shopper marketing activities along the path to purchase.

2.4 The elements of brand equity

Whilst marketing researchers agree that, from a consumer perspective, brand equity

represents the incremental value added to a brand name on to a product (Spry, et al., 2011). Several perspectives of brand loyalty have been studied by many marketers and researchers. The conceptual model for this study, as shown in Figure 2, is based on theoretical contributions from the brand equity models of Aaker (1991) and Keller (2003). The contributions of academicians towards brand loyalty are discussed below.

Research into Malls brand equity is limited in its research, so could a proxy of earlier research into the brand equity of an individual retailer can be relied on. “A retailer’s brand equity is exhibited in consumers responding more favourably to its marketing actions than they do to competing retailers” (Ailawadi & Keller, 2004, p. 332). Keller’s (2003) model around Brand Equity is simple, that to build a strong brand you need loyal customers. And to be able to build loyalty you need to shape what your customers think and feel about your product or brand. This involves building experiences around the brand so induces positive thoughts, beliefs, feeling and perceptions about it. Keller (2003) understood that when you have strong brand equity driven by your customers, they not only will buy more from you but in turn recommend you to other customers, making these loyal customers brand advocates on behalf of the brand itself.

Importantly the digital journey as a function of retail ambiance, customers’ associations with a brand, are based on how it makes them feel. “One of the most important things to understand about a brand is that its value is highly individualised. A customer might grow tired of a brand, or more captivated, independent of how other customers are responding to it.” (Rust, et al., 2004).

Whilst Keller’s model builds upon Kotler’s (2000) explanations, it adds the emotional attribute that appeals to the customer. The foundation of Customer Based Brand Equity is the creation of familiar brands with strong, positive and unique brand associations. To achieve this level of higher loyalty, brands need to be in touch with the needs and desires of the customer and ensure they meet those by altering themselves to appeal to those traits and not try sell them features and benefits of existing products. Hence, it’s not the brand that gives you the equity, but it’s the customer that passes their value onto your brand.

“Customer-based brand equity is defined as the differential effect of brand knowledge on consumer response to the marketing of the brand” (Aaker, 2004, p. 8).

Kevin Keller’s alternate model of Customer-Based Brand Equity foundation is that to build a strong brand companies should shape the feelings and thoughts that customers have about their product. This requires building the correct experiences around the brand, so that customers have positive thoughts, opinions, beliefs, feelings, and perceptions toward the brand (Keller, 2001). Remembering that a key pillar in supporting Customer-Based Brand Equity, remains the existence of initial brand awareness (Romaniuk, et al., 2004).

Within a pyramid (see Figure 3), Keller’s model is explained by going through four levels required to create a successful brand.

Brand identity – the need to make sure that the brand stands out, and customers recognise it and are aware of it. Brand awareness is a result of the accumulation of the number of brand exposures and experiences experienced by consumers.

Brand meaning – the building blocks of meaning are performance and imagery. Performance is how well the product meets the customers’ needs and imagery how well the product meets the customers physiological and social needs.

Brand responses – how customers judge and respond at an emotional (feelings) level to their perceptions of whether the product has met the promises it made regarding credibility, quality and superiority vs competing brands.

Brand Relationships – being at the top of the pyramid is indicative of the difficulty to reach this position. But as the most desirable positon to reach, the brand would have achieved brand resonance where customers feel a deep, psychological bond with the brand. The attitudinal attachment seen from customers’ fosters loyalty and active engagement around the brand.

2.5 Destinations as a brand

Konecnik & Gartner (2006) identified that for a destination, the same attributes that Keller identified held true towards building brand equity of the destination as depicted in Figure 4. Keller (2001;2003) argued the most valuable block in brand building is brand resonance, and that occurs once the other blocks have been established. The result is a brand which customers will actively seek and have a high degree of loyalty towards. Keller’ in explaining his model, felt that upon achieving true resonance other benefits would flow such as higher price premiums (margin) and greater efficiency and effectiveness of marketing communications (Keller, 2001; 2003).

As the rise of the brand of the retailer is one of the most important trends in retailing today, successful retail branding is becoming extremely important in influencing consumers’ perceptions and ultimately drive store choice and loyalty (Ailawadi & Keller, 2004). In examining the shopping mall experience and brand personality, Wan Kim, et al’s (2015) research correlated to Keller’s (2003) pyramid model in that the brand experience of a shopping mall is related to “brand attitude, brand attachment, and brand personality in the sense that it is a cognitive and emotional response of the consumer toward a brand” (Wan Kim, et al., 2015, p. 63). The focus in retailing has shifted from a transactional nature to one of building lasting relationships through unique shopping experiences (Jain & Bagdare, 2011). Gilboa & Vilnai‐Yavetz (2013) in researching malls found that for brand resonance of a mall that “shoppers who experience the mall as seductive, the interaction with the physical and social components of the mall’s or store’s environment is associated with emotional and cognitive reactions, eventually expressed in impulse buying” (Gilboa & Vilnai‐Yavetz, 2013, p. 253). “Retail stores act as retail theatre or experience factory for creating a pleasant shopping experience to improve customer satisfaction and loyalty” (Shilpa & Rajnish, 2013, p. 791).

To enhance the turnover of their tenants’ mall operators primary aim is to enhance the overall attractiveness of their venue by creating holistic experiences for their customers (Tandon, et al., 2016). Tandon, et al found this especially true since with the increasing amount of mall, customers now can select from multiple alternatives, and are more likely to patronise malls of higher attractiveness. In the face of increased competition within traditional brick and mortar retail now combined with online retail competition, Baker, et al. (2002) suggested the in-store experience to be even more critical as a competitive advantage.

Recently El Hedhl and Chabat (2009), have proposed a new retailing concept of shopper-based mall equity (SBME) as an extension Keller’s (1993) work on Consumer Based Brand Equity. They held that the goal of shopper-based mall equity is from the shoppers’ perspective to assess the equity or perceived value of a given mall and its effects on loyalty. The research by El Hedhl and Chabat (2009) indicates that shopper-based mall equity has a direct correlation to the commitment a shopper has to a particular mall, which is an additional and enhancing characteristics to Keller’s’ Consumer Based Brand Equity’s concept of brand resonance at the top of the pyramid in consumer relationships.

Achieving resonance by building loyalty and retaining existing customers is becoming of paramount importance in South Africa, since unemployment for the country in 2017 reaching its highest level since 2003 at over 27% (Statistics South Africa, 2017) meaning the base of consumers is diminishing, combined with a current recession (Kumwenda-Mtambo, 2017). Trading densities (turnover/m²), another key measure of retail performance continue to be under pressure, with recent statistics in South Africa showing growth at lower than inflation levels (Muller, 2017). This means shopping malls will be fighting for their share of consumer spend to occur at their property.

2.6 Loyalty

Key concerns amongst both mall developers and their operators is being able to attract shoppers followed by building and maintaining their loyalty (Babin & Attaway, 2000). This is becoming even more important for long term sustainability as South African mall operators “are facing further tenant failures and store closures as consumer spending tightens” (Muller, 2017).

Within a retail context, extensive work and academic research has already been focused on building customer relationships. This has mostly been cantered around the introduction of shopper loyalty or reward programs (Gomez, et al., 2012; Meyer-Waarden & Benavent, 2009; Omar & Musa, 2011), which simply rewards a customer for already having purchased the product. Does this however build loyalty towards the brand or product? Dowling (2002) argued that the proliferation of loyalty or reward programs was driven by a me-too attitude between retailers and may really be founded on marketing hype and exceedingly not cost effective in producing positive results.

Increasingly marketing is broader than the activity of selling, it is becoming concerned with the mutually satisfying exchange relationships, how to develop and maintain them (Baker, et al., 1998). To keep pace with increased competition and rapid technology changes, organisations have had to develop methods of building relationships and engagement with customers beyond traditional approaches, which had largely been based on transactional exchanges (Robinson, 2007).

Within large retail complexes, the experience can be a valuable one for the consumers if they derive additional value beyond simple finding the intended item, shopping value should account for more than the simple utility function of completing a purchase (Bloch, et al., 1986). To grow their market share and achieve a sustainable advantage over their competitors, mall developers and operators need to build shoppers’ loyalty (Wright & Sparks, 1999). Since mall operators charge their tenants not only ground rent, but typically also a percentage of their turnover, it is in the best interest of the mall operator to employ a loyalty strategy to drive up the sales of their tenants (Lehew, et al., 2002). New forms of experiences are emerging to build loyalty towards an individual shopping destination, many of these being technological enhancements such as charging stations for electric cars, the ability to find an empty parking spot upon entry, data analytics, in-mall navigation aided through Wi-Fi beaconing, and an allocation of free Wi-Fi data (Muller, 2017). Keillen Ndlovu, head of Stanlib a large property fund heavily invested in retail shopping malls, when interviewed by Muller (2017) acknowledged that landlords would need to improve the overall shopping experience for shoppers since tougher trading conditions leave landlords little choice should they wish to survive in an already over traded space.

Loyalty in the existing customer base is ever more important, as repeat business makes it easier to build a sustainable business. Yin Lam, et al. (2004) found that loyalty in an existing customer base is ever more important to build a sustainable business since it is costlier to acquire new customers than to build loyalty in existing customers, making organisations more profitable over time. An increase in loyalty towards a shopping mall not only reduces marketing cost if customer retention rises, but also because of word of mouth marketing by the shoppers themselves. “As long as mall shoppers find their shopping experience contributing positively to their sense of well-being, they likely to make positive references about the mall to others” (Hedhli, et al., 2013, p. 859).

Common to both the malls and their tenants is that at an elementary level, their lifeblood is the revenue developed through relationships with customers. And whilst revenue can be grown and advanced through cultivating relationships with new customers, by building loyalty they are able to get existing customers to spend a larger proportion of their available wallet share within the mall at the tenants (retailers), and by extending the lifespan of the relationship - seeking customers for life (Babin & Attaway, 2000).

Bloemer and Odekerken-Schroder (2002) found that store loyalty is the most important metric for retailers and can be defined as the continued commitment towards the store and that it is influenced by satisfaction and trust towards the store by the shopper. “Customer loyalty has a powerful impact on firms' performance and is considered by many companies as an important source of competitive advantage” (Yin Lam, et al., 2004, p. 293). Renowned advertising executive Kevin Roberts (Saatchi & Saatchi, n.d.), described how brands need to establish deep emotional connections with existing and potential customers and to accomplish this, marketers should be in tune with customers’ needs and wants. “Brand managers no longer own \'91their brand’. Brands are owned by the people who love them” Roberts as quoted (Cameron, 2015). Roberts states that traditional marketing is becoming extinct, since brands are becoming ubiquitous and commoditised. Roberts holds that to build successful brands, the focus should be on advertising (marketing communications), and that through the explosion of social media control has shifted from the marketer to the customer, who now directly influences perceptions about a brand (Cameron, 2015).

Based on Keller’s (1993) assessments, general relations between the constructs in building brand equity can be determined, since he states that when a consumer becomes familiar with a specific brand, the consumer will hold some favourable, unique and strong associations in their memory. Though, the content of each construct should still be adapted to the specific context of retail brands.

Jara and Clique (2012) using Keller’s model found that in respect to retail brands, the consumer’s response as shown through choice or intention to buy is directly influenced by the awareness of the retail brand. And, that the brand image of the retail brand is a facilitator variable in the relationship between retail brand awareness and the consumer's response (retail brand choice and intention to buy).

Shopping mall loyalty implies repeat patronage of a specific retail property. Regardless of obstacles, loyal customers consider patronising a specific shop as one of their highest priorities (Osman, 1993). There is limited research in respect to public Wi-Fi networks in shopping malls or their retail tenants, however in the case of Hotels research has shown that deploying Wi-Fi as a utility service to patrons increases their ratings from consumers by up to 8% (Bulchand\u8208 Gidumal, et al., 2011). This could be used as an effective tool to deliver suitable experiences to shopper, in shopping malls to nurture loyalty it has been shown to need emotional, engaging and consistent cognitive experiences are required (Tandon, et al., 2016).

2.7 Digital engagement, a personalised advertising medium

Keller (1993, p. 3) defined brand associations as "informational nodes linked to the brand node in memory that contain the meaning of the brand for consumers". By focusing on an emotional level, the associations created are not only stronger, but far longer lasting, fostering a greater sense of loyalty. With the increasingly rapid development within the area of one to one marketing, driven primarily using social media and online marketing, a brand is now able to be able to communicate tailored or personalised messaging to an individual customer to appeal to their specific emotional side and build individual relationships (Balakrishnan, et al., 2014).

It is imperative for organisations to be learning organisations, as an organisation is more likely to be hurt by emerging competitors or new technologies than by current competitors (Kotler, 2000). ‘Competitor myopia’ where an assumption is made that consumers will always buy from their category and focus is placed on product and not consumer needs has rendered some businesses extinct, as evidenced by major brands that no longer exist such as Kodak or Blockbusters. Digital channels for sharing and participatory activities represent a new and important way to communicate targeted messages to each different segment of customers, in contrast with mediums such as billboards, radio and TV and print where a brand had a singular message which would be received indiscriminatingly by all who saw or heard it (Murdough, 2009). Brands are now able measure effectiveness through the individual conversations that the customers not only start themselves but also continue to contribute to, either with the brand or amongst other customers.

Technology continues to pioneer not only the way that we operate but most importantly how we communicate with each other. With the proliferation of mobile devices, a new platform has emerged in which to communicate, specifically one that encourages personal interactions as opposed to mass messaging (Tsang, et al., 2004). Mobile phones have emerged as a digital notice board in every persons’ pocket that is able to receive direct and targeted messaging. The mobile phone is no longer a technological gadget, rather because of its personal nature it has become a cultural object with is part of everyday transactions and practises (Shankar, et al., 2010). Marketers can deliver their brand into the hand of the user.

As online channels for sharing and participatory activities represent an increasingly important way to communicate targeted messages to each different segment of customers (Murdough, 2009), location based digital marketing represents an additional way to target or narrow focus. “Mobile marketing is becoming increasingly important in retailing. Due to the time-sensitive and location-sensitive nature of the mobile medium and devices, mobile marketing has the potential to change the paradigm of retailing” (Shankar, et al., 2010, p. 111).

Since Shoppers are now using their smartphones to search for products and obtain peer and expert reviews prior to entering a store, the out of store communication becomes an important drive for preference and loyalty (Shankar, et al., 2011). The interactive communication channels have essentially reassigned the control of the brand messages to the consumer. As well as being able to govern the timing and regularity of online brand interactions, peers through their social media interactions are now influencing the content of these communications through active involvement with brands (Mangold & Faulds, 2009).

Today’s discriminating shopper wants a targeted, personalised retail experience, that includes tailored offers that match their buying habits. And they want them on their mobile devices.

2.8 Wi-Fi as an engagement platform

“With the rapid rise of personal digital technology, customers have become savvier and more demanding about how they want to interact through technology. No longer can a business assume that the experience it has with its customers is good enough, or that it will not need to change in a short time.” (Wallace, 2015, p. 9)

Because of the unaffordability of laptops and desktop computers for the average South African, the majority internet usage in South Africa is based on a mobile phone (We Are Social, 2017). Within the adult population, We are Social’s (2017) research indicates more than 69% have a smart phone whereas less than 20% of a computer. With just over 50% (Internet Live Stats, 2016) of the South African population having access to the internet, whether at home, work or through shared resources such as web cafes. Consumers want mobile digital experiences that don’t rely on having their own broadband connection (Internet Live Stats, 2016), the mobile phone interactions could be delivered to shoppers to form pervasiveness within South Africa. A significant opportunity presents itself, since in South Africa mobile data costs exceed $0.20 per megabyte the attraction of free data in exchange for interaction with a brand could driving higher effectiveness.

As a connectivity medium, commercially deployed Wi-Fi is not only faster and more robust than GSM networks but also more cost effective for end users (Gammell, 2014). Consumers are actively seeking out free to use Wi-Fi networks to save costs, but at the same time the beaconing that the device in their pocket constantly emits allows the operators of Wi-Fi networks, albeit at an anonymous level, to form segmentation insights about the user (Cunche, 2014).

More retailers are now tracking shoppers on an anonymous basis to collect information on them such as which area of the shop they are in, how long they spend in the shop, how often they visit and correlation of visits between different shops. This could assist in establishing a view of the shoppers’ habits in a similar manner online retailers can build insights through their customers’ behaviours (Gallinaro, 2015). It also requires no action on the shopper’s part, making it passive collection (Cunche, 2014). Wi-Fi is proving not only to be convenient for casual visitors to use, but also for business owners to deliver tailored messages to each user and use Wi-Fi networks as a valuable source of actionable business intelligence (Leposa, 2013). Research by FreeFi has shown that except for intrusive pop-up ads, users don’t mind being served advertising in exchange for receiving an allocation of free Wi-Fi (Mobile Pipeline News, 2004). Morey, et al. (2015, p. 99) found that “consumers appreciate that data sharing can lead to products and services that make their lives easier and more entertaining, educate them, and save them money.”

Consumers are now more willing to part with personal information as a value exchange with organizations (Chellappa & Sin, 2005; Hagel III & Rayport, 1997). Social media networks represent an example where the user of the network freely gives up information such as gender, address, employer, personal interests and more private information in exchange for not being charged a recurring amount to use the network. “Value exchange is not an unrelated transaction whereby a company gives a coupon or some other “giveaway” in return for information. Instead, best practice companies use the very information that the consumer offers as the source of the value given in return. As such, value exchange is a way of building a relationship with consumers, providing marketers with what amounts to a non-stop focus group” (Abela & Sacconaghi Jr, 1997). Thus, the user of the free service has become the product as the point of monetization has shifted. This phenomenon is explored by McKean (2014), who points out that these volunteered insights are only useful if organizations can action them in their marketing mix. “CMOs used to try to shape customers’ desires; now they’re actually learning how to predict them.” (McKean, 2014, p. xvii).

The research depicted in Figure 5 by consulting firm Deloittes (Lobaugh, et al., 2014) highlights that brick and mortar retailers need a strategy that focuses specifically on how they can support their customers digital shopping experience once they are already in the store itself. The study also demonstrates that the consumers mobile phone is central to the formation of any strategy. Typically, a mobile phone is used by one individual, making them ideal for individual-based target marketing, and through this targeting a superior consumer value proposition can be delivered.

By enabling digital communication mediums to allow consumer participation in virtual communities has the positive effect of adding to consumer loyalty, the digital interaction is the new-age field marketing services delivered directly to the pocket of the consumer (Shang, et al., 2006). Haims (2015) contends that customer loyalty driven by the availability of Wi-Fi in the retail environment is at play, since many customers may have already formed a relationship with, and affinity for stores that they shop at regularly. Whilst she also finds that many retailers in a mall have an increase in customer acquisition by having shoppers entering their stores because they have learned about the brand or seen a promotion through the Wi-Fi landing pages after already having arrived at the mall. “Shoppers who sign onto mall- or store-based Wi-Fi networks have reason to stay on the premises longer, providing retailers an extended opportunity to connect with more customers and clinch further sales — both by developing their customer acquisition pipeline as well as strengthening existing customer loyalty.” (Haims, 2015). Promotions that are of an educational or edutainment nature about the location should not be discounted since these messages form an important component of the positioning strategy of the mall (Parsons, 2003).

Mobile phones are becoming ubiquitously pervasive for most of the planet, and consumers are looking for more utility out of what they can deliver. “Computing-you-carry is about mobility and movement. It is about bringing the power of the computer with you, of allowing your mobile self to connect beyond the self, to leave a trace or remnant, to remain connected” (Wilson, 2014, p. 538). The need for continuous connectivity has triggered the development of digital spatial media and influences the contemporary production of spatial knowledge about the users (Wilson, 2014).

At a primary level, Wi-Fi can deliver internet connectivity to its users within a shopping mall, or retail tenant space. But does the simple provision of internet do anything to build any equity or loyalty towards the brand? It would appear only to be saving the consumer money from their own mobile data bill (Gammell, 2014), without the user participating in the value exchange with the brand itself. This represents a significant opportunity for mall operators to deliver beyond the sheer promise, where the experience of the brand is equally important. Using digital mediums can lead to the more complete view on branding according to which the brand is the result of all impressions and experiences the brand has delivered. “The brand communication and experience impacts customers’ perceptions about the brand and what it offers.” (Lindemann, 2010, p. 117)

CHAPTER 3: DATA AND METHODS

3.1 Introduction

This research is an effort to identify actions that a mall operator can take to build the consumer brand based equity towards their venue and retail tenants, by seeking what strategic initiatives they should implement in the arena of venue based Wi-Fi to add to the atmospheric dimension to the brand. In addition, the researcher will seek to identify associated services using the technology that adds utility to the customer at a shopping mall, whilst also constructing a better picture about the customer.

Specifically, the following research questions are posed:

- How do consumers perceive value delivered to them by brands that use contextual messaging?

- What factors determine or build consumer based brand equity (CBBE) prior to purchase?

- How can marketers use new technology to engage in dialogue from an untargeted broadcast message to tailored messaging to individual or groups of users?

- In a mobile first society how can marketer increase the personalisation?

- What kind of experiences should brands deliver to enhance their CBBE?

The absence of existing theory about mall loyalty influenced the decision to adopt an approach through quantitative research to answer the research questions. Since the objective was to understand how many people display tendencies or preferences towards the mall and its Wi-Fi network as an influencer of loyalty, it was decided that quantitative research was most appropriate for measuring both attitudes and behaviour. Importantly it would allow the researcher to measure segments of users, to estimate business potential, and to measure the size and importance of segments that exist in a market.

Blaxter, et al. (2001) explained that the main differences between the two main research methods are firstly how qualitative surveys are subjective concentrating more on the respondents’ natural behaviour and personal viewpoints, whereas quantitative methods utilise a more measured form of dimension that can be statistically analysed, formatted and allowing comparisons, making it more objective.

Whilst it was the intention of the researcher to augment these quantitative findings with qualitative research, but due to confidentiality around their material industry experts were not prepared to formally participate.

3.2 Conducting the research

Using an online survey injected into a public Wi-Fi journey, the questions were set to explore direct measures of CBBE being relationships and response, and questions to identify Keller’s (1993) indirect measures of CBBE of identity and meaning. Participants were not identified prior to conducting the research and participated through their own discovery of the Wi-Fi.

Within the structure of the survey questions have been posed to confirm later responses, for instance a question dealing with would a shopper prefer free Wi-Fi or free parking is used only in context of users who also identified that they own a car, as a non-car owner’s response would not be of value since free parking is of no use to them.

3.3 Survey presentation and structure

The survey was constructed using a linear response method on the Wi-Fi landing pages (see Figure 6) in three major regional shopping malls. Questions that were asked specifically to clarify applicability of other elements were separated by several other questions, to ensure users did not consciously manipulate their answers. Only fully completed responses will be collated and analysed.

The responses will be collected into a database and exported into a CSV file to allow additional reporting on the variables. For purposes of analysis the respondents will be indexed to allow for the lookup of an individual user record, but through indexing them the names, phone numbers and email addresses of the respondents will be hidden to ensure anonymity.

3.4 Methodology

A pilot survey was initially conducted and through this process the question set was refined to include how many stores the person intended visiting, whether they would recommend the mall to a friend but most importantly whether they planned to return to the venue. These refinements were made specifically to understand emotional attachment and loyalty through the desire to return to the venue.

As there is no explicit way to prevent employees of the mall or its tenants from taking the survey clarifying questions were posed to identify between respondents whom worked at the mall versus those that came to the mall with the clear intention to shop and those that accompanied shoppers or were simply there for the entertainment value. None of these groups will be discarded since the literature identifies experiences and entertainment value of the mall are key drivers to increase loyalty and these users could at any moment spontaneously convert to a being a shopper once in the mall. Similarly, Workers at the mall can also be Shoppers, they may not have chosen to come to the mall to shop, but whilst on their breaks or post their shift they too become potential Shoppers. Whilst those persons that accompany a Shopper may have influence on the habits of the Shopper and could also convert at any time to being a Shopper. So, all groups will be considered, but comparative between them will also be possible.

The method of collecting the survey response would be in the basis of users voluntarily participating in a survey. The survey would be conductive using the mall Wi-Fi in three large shopping malls. To remove geographic preferences or bias, a mall was selected in each one of Gauteng, Kwa-Zulu Natal and Western Cape Provinces, and each of the malls selected were mid to large sized of a minimum of 75,000 square meters of retail space. By selecting venue in provinces separated by hundreds of kilometres it is anticipated to get a response representative of the diversity of South Africa and its population. As responses would be collected over the busiest period, being weekends, it is anticipated that many hundreds of complete responses will be collected. A minimum “n” of 700 complete responses was targeted prior to analysis beginning, as the researcher felt any lower value would not be a large enough sample size to provide a reliable sample size.

Users would be presented with the survey after completing an online form detailing their name, contact details and gender. The survey is completed by a responder through serving web pages containing the questions. To remove potential subjectivity in analysing the results all questions consisted of either a yes or no answer, or answers from a selection of questions. The answers would be selected through either a radio check boxes making the experience on a mobile device simple through clicking on the desired response to a question.

The sampling tree would be significantly impacted by the shoppers’ awareness of the Wi-Fi network and further reliant on a user actively seeking out and connecting to the Wi-Fi network. The sampling tree is shown in Figure 7.

3.5 Survey questions

It is not anticipated that there are ethical concerns, since all respondents participated voluntarily in the survey. Responders would also need to accept terms and conditions of use of the Wi-Fi network which explicitly alerts them that their volunteered data may be used by third parties for research or marketing activities. For analysis, identifying information on individual respondents has been removed from the data.

CHAPTER 4: ANALYSIS AND RESULTS

4.1 Introduction

Ailawadi & Keller (2004) suggested that to capture a positive image in the minds of shoppers, that shopping malls be measure on five dimensions, access, atmosphere, price and promotion in context to both cross-category and within category assortment. It is with these five dimensions in mind that this study will determine if digital experiences using public free to use Wi-Fi availability in shopping malls has a direct influence on any of them, since consumer perceptions of them helps form the image and associations held by the consumer about the brand.

The responses have been visualised to identify themes that enlighten an understanding of how users respond to the different types of interactive marketing on public free to use Wi-Fi, and how their preferences determine these responses and how this impacts their emotional reactions and relationships with the brands they interact with.

4.2 Method of analysis

The survey is categorised as quantitative since it was administered to a large population to get statistical data. All questions were closed-ended. For example, most questions were limited to a Yes or No and other still only allowed selection form predefined response. The respondent was still able to express an opinion, but it was fixed into a predetermined construction that did not allows them to elaborate via any free test fields. The results collected were stored in a CSV file format and after delimiting the data, was loaded into Microsoft Excel to begin analysis. The data was put into various pivot tables which then allowed for the comparison of different variables, as well as the ability to run indexing and present the data in a variety of visual charts.

Excel has been selected as it is an efficient number cruncher and suited to quantitative data analysis, being able to handle large volumes of data, provide numerous attributes, and allow for a selection of display techniques.

4.3 Data universe origin

The timing of when the survey was to be conducted was chosen to specifically include a Saturday and Sunday for two important reasons, firstly the peak traffic of a weekend would ensure a higher likelihood of reaching the desired number of responses. But more importantly it is anticipated that shoppers having more free time during a weekend would select their mall destination through considered choice as opposed to hurrying to the nearest mall during the week for groceries or other items based on the malls location to their place of work.

Although it was targeted and anticipated to receive a few hundred responses, after discarding incomplete responses, ten thousand seven hundred and seven (10,707) responses were received over the two-day period (see Figure 8).

The response rate from the Kwa-Zulu Natal Mall was lower than anticipated and it was identified that most failed questionnaires were in this mall, and it could also be linked with the lack of awareness of the Wi-Fi itself, since the mall only recently opened to the public. Any potential gender bias has been accounted for, since the overall responses between gender varied by less than 0,5%.

4.4 Categories of responders (“User Groups”)

The respondents have been categorised into four different groups, through their own responses to the question of why they came to the mall.

I came here to shop (“Shoppers”) - These respondents are of the highest value, since they arrived at the mall with intent to buy. And it is their preferences and emotional responses that it is aimed to understand best.

I came with someone with is shopping (“Followers”) - This group has not come with the intent to buy, but rather followed a shopper to the destination. They may have the ability to become influencers once at the destination by becoming impatient and bored resulting in pressure to leave the mall, or inversely be influenced to get the shopper to spend more or be persuaded to become a shopper themselves, crossing groups during their visit.

I came to entertain myself/kill time (“Entertainers”) - Although they have not come to purchase, the research by Lloyd, et al. (2014) identified that the entertainment value of a mall, is part of the consumers’ lifestyle. This person has also made a free choice to visit the chosen mall, and if induced through experiences could become loyal to the venue.

I work here (“Workers”) - This group, have not made a choice to visit the mall, save for their choice to be employed. The results of loyalty on this group will be discounted, however they will still form part of analysis of aspects of experiences and desires, since in their breaks or before and after their shifts that too are shoppers and can be influenced to spend money at the mall.

| Figure9: Responses by Grouping into Categories |

Whilst a satisfactory amount of responses was received from shoppers to interpret for the research, and when combined with the Followers was almost half the universe. But, it was observed that 40% of total respondents came from persons who work at the mall, or for the tenants in the mall. It would be unwise to eliminate them from using the public Wi-Fi since they themselves could also be shoppers (see Figure 9). Since on the busiest days of the week 40% of users are employees, that this number would tend to be higher in the week when the mall is quieter, so mall operators should be cognisant of the different groupings and deliver and differential experience to them. Particularly since a mall operator would not want the employees lowering the service quality experience of the Wi-Fi for actual shoppers. But through tailoring messaging, mall employees could become a virtual extension to the service experience of visiting the mall. Examples could be empowering them as informational ambassadors or creating them of roving or mobile points of sales to make a shopping experience more fluid for a shopper.

Most respondents were found to be people who either work at the mall or they came to shop, however, 20% of people who visit the mall have no intention to buy. This people are there to either kill time or they came with someone.

4.5 Visitor profiles

In this section, the researcher considered the different groups of people who visit the mall and then profiled them based on gender, region, time and day they are likely to visit the mall. To further understand the behaviour of different groups, items they are likely request on the landing page, number of stores they are likely to visit and how often they visit the mall were also looked at.

Figure 10: % distribution by gender of Shoppers compared to the universe | Figure 11: % distribution by region of Shoppers compared to the universe |

Firstly, shoppers were profiled. These are people who visit the mall with the intention to shop. Figures 10 and 11 above show the gender and region distribution of Shoppers compared to the universe. The inner chart is the universe spilt and the outer chart is the Shoppers’ distribution. There are no significant differences between the universe distribution of gender and gender distribution of shoppers. This is also evident in the distribution of region.

Figure 12: % distribution of Shoppers by day indexed against the universe

Figure 13: % distribution of Shoppers by time indexed against the universe

As shown in Figure 12 and 13 people appear to prefer to shop late on Sundays. Male shoppers are 1.2 times more likely to shop a bit later as opposed to the females whilst Western Cape shoppers are even more likely to shop later in the day. This could be a result of the sun setting later than other regions.

When asked what they would like to see on the Wi-Fi landing page, Shoppers are 1.2 times more likely to request for special offers (see Figure 14). This is largely influenced by female shoppers. Along with special offers, shoppers are likely to request a mall map and store directory. This is strongly influenced by Gauteng shoppers. People who visit the mall with the intention to shop are also likely to visit three or more shops whilst first time visitors are more likely to come back (see Figures 15 and 16).

| Figure 14: Indexed landing page preferences of Shoppers compared to the universe Figure 15: % distribution by number of stores of Shoppers compared to the universe Figure 16: % distribution by How often they visit the mall of Shoppers compared to the universe |

| Figure17: % distribution by gender of Workers compared to the universe |

Secondly Workers have been considered, the universe has an equal proportion of males and females but there seem to be a larger proportion of female Workers as opposed to their male counterparts (see Figure 17). This suggests that people who work at the mall are more likely to be female.

| Figure18: % distribution by region of Workers compared to the universe |

People who work at the mall are likely to connect in the morning and on Fridays right before their shift. This might be the best time to communicate with employees. Geographic differences as shown in Figure 18, are not material and could be ascribed to many factors.

As shown in figures 19 and 20, they are most likely to visit only one store on a weekly basis (probably where they work). When asked which items they would like to see on the Wi-Fi landing page, employees are far less likely to request a mall map and store directory, due to their own familiarity with the mall.

| Figure 20: % distribution by How often they visit the mall, of Workers compared to the universe |

Entertainers are the people that visit the mall to kill time and are observed to be 58% male, 8% more than the universe (see Figure 21), and 1.2 times more likely to be male. They are also 1.2 times more likely to be from Kwa Zulu Natal (because of a small sample from Kwa Zulu Natal, this needs to be interpreted with caution); whilst they are less likely to be from Gauteng (see Figure 22).

Figure 21: % distribution by gender of Entertainers compared to the universe | Figure 22: % distribution by region of Entertainers compared to the universe |

Like the Shoppers, Entertainers are also more likely to visit the mall on Sundays from the afternoon (see Figure 24), however they are also likely to visit on Saturdays (see Figure 23). This is largely influenced by males whilst Females would rather come on Sunday (see Figure 23).

Figure 23: % distribution of Entertainers by day indexed against the universe | Figure 24: % distribution of Entertainers by time indexed against the universe |

Entertainers are 1,3 times more likely to request a mall map on the landing page but less likely to request a store directory (see Figure 25). They are also likely to visit at least two stores. Gauteng residents are 1,4 times more likely not to visit the mall again for entertainment, further diagnosis is needed to determine the factors affecting this mall.

Figure 25: Indexed landing page preferences of Entertainers compared to the universe

Like the Entertainers, the Followers group is also 1,2 times more likely to be male (see Figures 26 and 27). Whilst a further study should be conducted to understand this, it could possibly be husbands accompanying their wives, as evidenced in previous studies where up to 85% of the primary shopping responsibility in households still rests with the female (Dholakia, et al., 1995). Followers are also likely to be from the Western Cape.

Figure 26: % distribution by gender of Followers compared to the universe | Figure 27: % distribution by region of Followers compared to the universe |

As shown on Figures 28 and 29, about 25% of Followers visited the mall on Sunday evening whilst only 18% of the universe visit at that time, indicating a time shift in activity through the day. This could indicate that core utility of the mall is shifting at different points of the day.

Figure 28: % distribution by day of Followers compared to the universe | Figure 29: % distribution by time of day of Followers compared to the universe |

This group is 2 times more likely not to visit the mall again. They are also likely to request a mall map and store directory on the Wi-Fi landing page and are more likely to visit at least two stores at the mall (see Figure 30).

Figure 31: Distribution by number of stores of Followers compared to the universe | Figure 32: Distribution by How often they visit the mall of Followers compared to the universe |

Figure 31 shows that Followers are more likely to visit on 2 stores in the mall and Figure 32 shows it is most likely their first visit to that mall indicating a curiosity to discover within the new environment. | |

4.6 Intent about their visit to the mall

When excluding Workers from the analysis the following was found: 85,38% of respondents indicated that they were more likely to visit a mall that offered mall Wi-Fi. With 68.36% stating that they specifically chose to come the that mall, because it offered mall Wi-Fi.

When trying to understand loyalty it was tested to see what impact Wi-Fi availability would have on the likelihood that the person would return to the mall, and 83,21% of respondents (excl. Workers) who said they came to the mall because of the mall Wi-Fi and said they would return to that mall, implying loyalty through their repeat patronage.

It emerged from the data collected that Wi-Fi plays a critical role in the experience of the non-Worker at the mall. Importantly, at an emotional level, 78,09% of respondents (excl. Workers) stated that receiving mall Wi-Fi made them feel valued as a customer and would return to that mall, with over 90% stating that receiving mall Wi-Fi made them feel valued by the mall as a customer.

In an era of social media and the emergence of peer induce influence, 75,09% of respondents (excl. Workers) indicated that they came to that mall because it offered mall Wi-Fi and they felt valued by the mall and would recommend the mall to a friend.

At 2,82%, less than 3% of respondents stated that although they preferred a mall with Wi-Fi they would not return to the mall they were surveyed at, leading the researcher to conclude that in-mall Wi-Fi has a significant impact on the selection of which mall to visit.

Importantly 43,35% of Shoppers chose to the mall they were surveyed at because it has free mall Wi-Fi and 72,73% of these persons planned to visit more than three stores, implying that should the mall have not had Wi-Fi available then 31% of the sampled universe of shoppers would have selected another mall to visit.

Figure 33: Distribution by Landing Page preferences of discontent people compared to the universe |

Figure34: % distribution by gender of discontent people compared to the universe

| Figure35: % distribution by visitors of discontent people compared to the universe |

To gain an understand on loyalty, the researcher profiled people who said they won’t visit the mall again. The discontent visitors were defined as first time visitors who said they would not return to the mall. Only 3% of the respondents (likely to be Male who accompany someone who is shopping as shown in figure 34 and 35) said they might not visit the mall again. These people are 1,6 times more likely to request a mall map on the Wi-Fi landing page (see Figure 33). This could indicate that they struggled finding their way around the mall. As depicted on figure 33, this group of people are also likely to request anything that will keep them busy such as News, weather and adverts indicating they may be bored and are looking to be entertained.

First time visitors who plan to come back again are more likely to be shoppers. These customers are likely to request for a mall map and store directory to find their way around the mall. Since they are shoppers, they would also like special offers on the Wi-Fi landing pages.

Figure 36: % distribution by item of content people compared to the universe

Customers who said they will come back again (content) were also profiled to have a better understanding of what is making them return. First time visitors who plan to come back again are 1,5 times more likely to be shoppers as shown on Figure 38. Gender for content visitors is shown in Figure 37. These customers are also likely to request a mall map and store directory to find their way around the mall. Since they are shoppers, they would also like special offers to be presented on the Wi-Fi landing page (see Figure 36).

Figure 37: % distribution by gender of content people compared to the universe | Figure 38: % distribution by visitors of content people compared to the universe |

Figure39: Preference of Free Parking vs. Wi-Fi

It is common place in most South African malls that beyond a free period of approximately 30 minutes’ visitors need to pay for parking within the mall precinct. The researcher has assumed this is a grudge purchase as there is no ability to substitute should you drive to the mall in your car. The researcher tested for the ranking of additional free Wi-Fi versus receiving free parking and the results were surprising. It was found that 1 in 2 car owners who visit the mall (excluding people who work there) prefer free Wi-Fi as opposed to free parking (see Figure 39). For these customers, free Wi-Fi seems to be a major driver when deciding on which mall to visit.

4.7 Landing page preferences

The landing pages on public Wi-Fi being the splash pages the user receives on their device, represents an important touch point to be able to hold a dialogue with the user. For this the researcher wanted to explore what were the items of value to the user, as assessed by them. The questions were designed to expose what items that would give the user utility value from engaging with the Wi-Fi platform.

Special Offers - Specific Offers that were valid on that day from retailers within the mall.

Coupons - Availability of coupons that a user could receive and redeem instantly at a retailer via point of sales integration.

Store Directory - A directory of tenants.

Mall Map - A map of where to find the tenants, toilets, food court etc.

Mall Info - Information such as open and closing time, contact details of the management.

Events and Promos - Details on upcoming mall wide events and promotional activities.

News - Real time news feed.

Local News - Localised news feed from the area being a town or province.

Weather - Weather forecast for that location.

General Advertising - Targeted advertising unrelated to mall specials.

Figure 40 plots the preferences of the universe to view the trends between the different geographies and genders. What the figure shows is that overall the items that users get most utility out of move in sync closing whether viewed on a province, gender or national basis. The overwhelming items that users wish to receive via Wi-Fi are special offer, Mall Map, Coupons and detail on Events and Promotions. This indicates that in recessionary times, shoppers are seeking to save and get maximum value out of their disposable income. A mall map feature high on their needs analysis, and this would complement serving them special and assisting them in finding the applicable store. Having the ability to navigate to a store also improves the return for the tenant and mall operator as it increases the propensity to conclude a successful sale.

| Figure 41: Landing Page Preferences |

Figure 41 groups preferences by User Groups, to understand what the groups preference are to see on landing pages.

To better understand the different groups, the spider diagram on the previous page was indexed against overall clicks (see Figure 42 below). This will allow the researcher to identify which group is more likely to request each item on the landing page as compared to all groups. The following insights were identified.

Figure 42: The preferences of Gauteng and Western Cape (sorted by gender) on which items to view on the Wi-Fi landing page indexed against the universe |

The researcher then using the indexed data mapped each user group against the landing page item preferences selected by them. To display the data used here, the researcher is aware that using a continuum style chart is not appropriate, however to allow a casual reader to be able to easily identify trends or patterns a charting style using a continuum was used to be able to visually identify the inverse preferences that different groups exhibit.

Figure 43: Indexed Preferences by User Groups |

4.8 Research conclusions

As a group, the Shoppers exhibit the highest need for detail on specials and coupons to allow instant savings coupled with a need on who the tenants are and where to find them. The Shoppers needs from utility items such as news and weather is amongst the lowest, only Entertainers have a lower need validating the non-specific nature of their visit. 49,95% of Shoppers also indicated that they would use the internet to conduct research about the purchase they came to make at the mall, representing an opportunity to use the landing pages to educate them about the stores and their offerings.

CHAPTER 5: DISCUSSIONS AND CONCLUSIONS

5.1 Key findings

The global economic recession of the late 2000’s hit everyone harshly, and no doubt the current recession in South Africa (Kumwenda-Mtambo, 2017) will also have far reaching impact. Recession impacts retail stores quicker than other sectors as consumers rein in their spending and retailers then grapple with ways to begin topping sales again. As the economy slowly comes crawling back to life it’s safe to say creating the finest customer engagement and experiences in stores is at the top of everyone’s list for maintaining loyalty and growing sales.

In South Africa retail is experiencing an unprecedented era of mass closures or major brands. The Harrods of South Africa, Stuttafords, which has a history of 159 years has as recently as July 2017 shuttered its doors followed by major international retail brands like Nine West, River Island (Brand-Jonker, 2017). These closures are negatively impacting the value and share prices of the mall operators (Anderson, 2017), and they are looking for ways to make themselves stand out amongst their competitors to lure customers.

Customers are demanding a shopping experience that “connects the dots” along their path to purchase. Viewed in isolation their discrete interactions across multiple mediums is meaningless, but when viewed holistically the interactions with the touch points can become powerful predictors of preference and purchase intent. The research also showed that half (49,95%) of shoppers expected to use the internet to research their purchases whilst at the mall.

The higher number of data points and insights that a mall operator can conclude about their shoppers, the clearer the overall picture becomes of the shoppers and their segmentation. This will enhance the ability of the mall operator to manage their marketing mix to achieve a higher level of loyalty and ultimately spend at their retail tenants. “Shopper marketing also serves to enhance brand equity in the long run” (Shankar, et al., 2011, p. 31).

To increase traffic in a mall, it is necessary to create a strong brand image for a mall, as the perception by shoppers will be received as the mall delivering them a unique bundle of benefit and not the simply utility of completing a transaction. The data shows that the shopper’s positive awareness of the mall characteristics influences his/her commitment to the mall, in line with the research of Aaker (2004) in which customer-based brand equity is the response of the consumer to the messaging of the brand.

The foremost goal of this study was to propose and to test a conceptual model to explain the possible impact related to mall loyalty, by using Wi-Fi as an omni-channel tool.

Selling activities needs to evolve from generically shouting a message at a group of customers and hoping it resonates, to initiating dialogues which can be maintained with customer on an individual basis the ability to target bespoke messages has increased. By appealing to each customer as individuals with tailored messages a brand can build a relationship and ultimately loyalty. Key to this is being able to build a mobile first strategy, by 2015 already more than one third of global web traffic was via mobile devices, and is expected to rise by 5% annually (Kemp, 2016), meaning within a limited screen real-estate brands are competing within a limited screen sizes which makes succinct messages even more important.

Technology will continue to increase the level of automation for a lot of routine and mundane processes that happen in retail stores. Whether it is self-service check-outs, beacon and Near Field Communications technology for brands to trigger push based marketing, or in-store navigation to make it easier for customers to self-navigate around stores, technology will play an increasing role in automating the retail experience.